what is schedule h on tax return

Schedule h-detailed allocation by city of taxable sales and use tax transactions of 500000 or more. Tax schedules generally have several lines on.

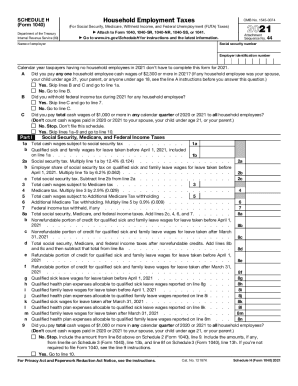

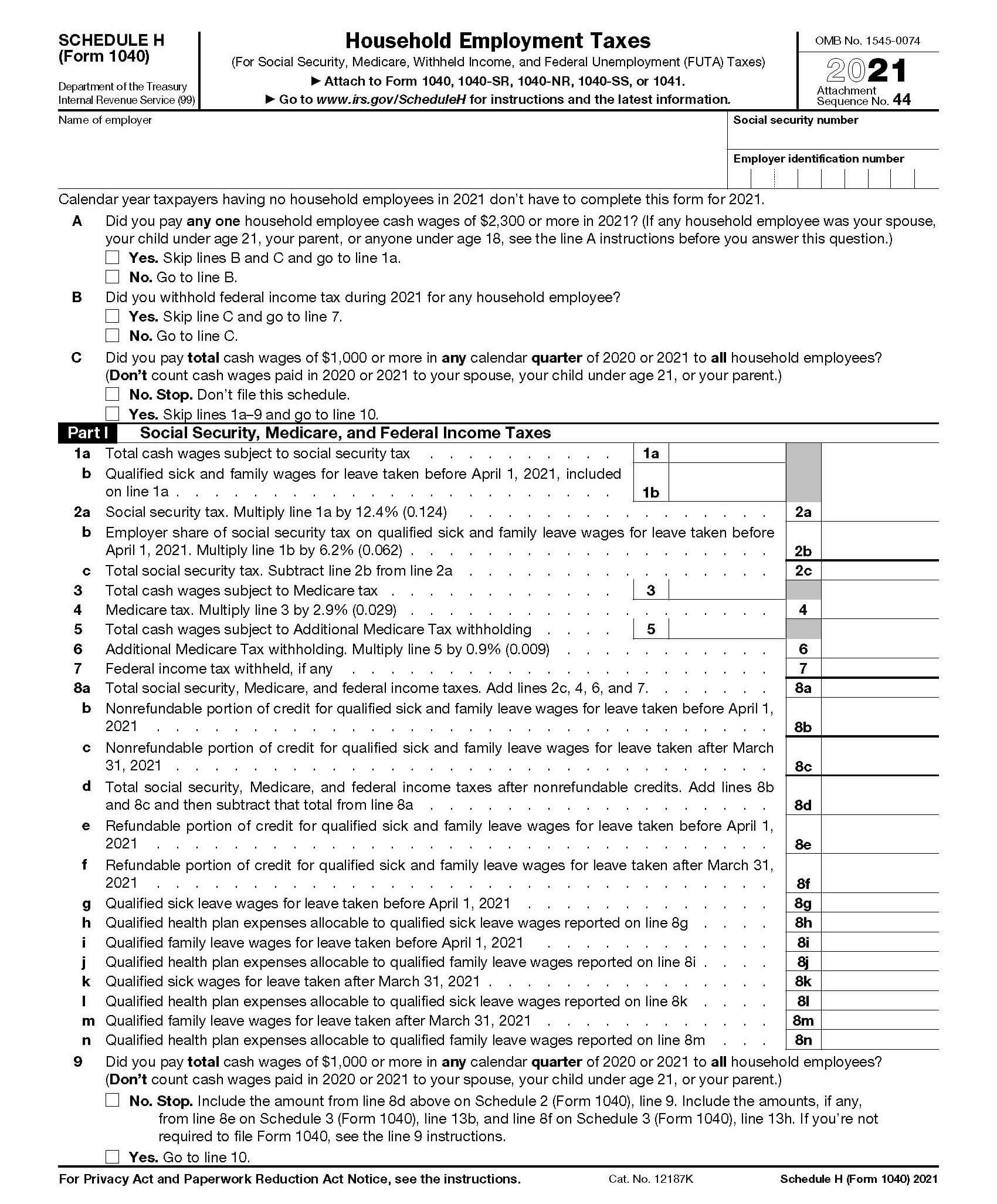

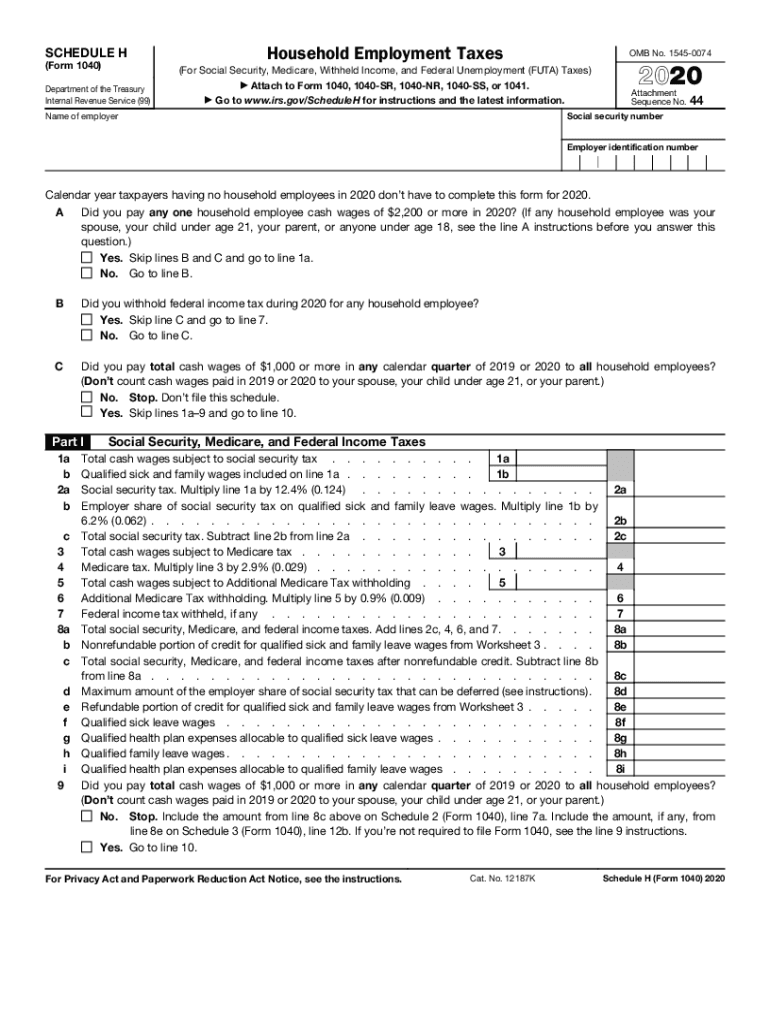

Irs Schedule H 1040 Form Pdffiller

Web Your tax return must include Schedule H only if you pay any single employee at least 2300 in the 2021 tax year or cash wages to all household employees totaling.

. Web Generally any foreign corporation that is required to complete Form 1120-F Section II must complete Schedules M-1 and M-2 Form 1120-F. When you paid cash wages to a household. Use Schedule H Form 1040 to report household employment taxes if you paid cash wages.

Web A tax schedule is a tax form used to make additional calculations or report additional information on a tax return. If you employe any of the workers above and pay them 2200 or more in wages during the calendar year you are subject to payroll. Web Schedule H is used by household employers to report household employment taxes.

Web To qualify for the HR Block Maximum Refund Guarantee the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller. Web Schedule H is the form the IRS requires you to use to report your federal household employment tax liability for the year. Web What is tax schedule.

Web cdtfa-531-h front 5-18 state of california. A tax schedule is a form the IRS requires you to prepare in addition to your tax return when you have certain types of income or deductions. Web Schedule C of Form 1040 is a tax schedule that must be filed by people who are self-employed.

Web Schedule H often referred to as the nanny tax is a form you file with your taxes if you have household employees that you paid more than 2300 in the year or 1000 in. California department of. Schedule C is the tax form filed by most sole proprietors.

The IRS requires you to report household employment taxes on Schedule H with your personal tax return. Web A tax schedule is a form the IRS requires you to prepare in addition to your tax return when you have certain types of income or deductions. Web The Nanny Tax and Schedule H.

Schedule H Form 1040 for figuring your. According to the most current IRS. Web 2021 Instructions for Schedule HHousehold Employment Taxes Here is a list of forms that household employers need to complete.

Web What is Schedule H. As you can tell from its title Profit or Loss From Business its used to report. Its a calculation worksheet the Profit or Loss From Business statement.

Web A tax schedule is a form the IRS requires you to prepare in addition to your tax return when you have certain types of income or deductions.

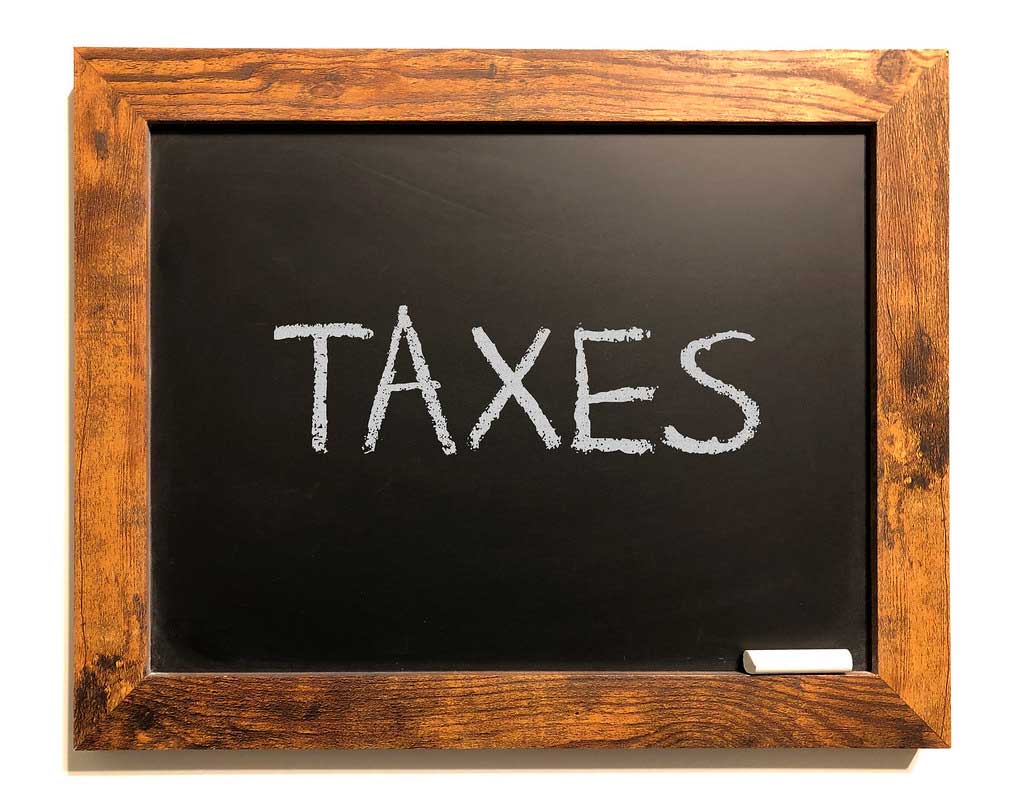

Solved Dest Answer Which Of The Following Is True Regarding Chegg Com

1040 2021 Internal Revenue Service

2021 Schedule H Form And Instructions Form 1040

Fillable Online Irs How Do I Fill Out 1120 Schedule H Form Fax Email Print Pdffiller

Us Tax Forms 1040 And Schedule H Stock Photo Download Image Now 1040 Tax Form 2000 2009 2008 Istock

Prepare And File Schedule H For Household Employment Taxes

Who Should File Irs Schedule H

Schedule H Form Fill Out Sign Online Dochub

What Is A Schedule H Tax Form And Why Should I File One

Form St 100 7 Fillable Quarterly Schedule H Report Of Clothing And Footwear Sales Eligible For Exemption

Form 1040 Schedule H Household Employment Taxes

Tax Forms Irs Tax Forms Bankrate Com

Individual Income Tax Forms Instructions Tax Year 2020 Annus Horribilis Ayala Luis 9798582477075 Amazon Com Books

File A Schedule H With Your 2022 Tax Return If You Hire A Household Employee Care Com Homepay

What Is A Schedule H Obligations How To File More

Community Benefit Reporting On Irs Form 990 Schedule H What Does Your Hospital Need To Know Ppt Download

Form 1040 Schedule H Household Employment Taxes

Household Help Could Mean More Tax Work For Employers Don T Mess With Taxes